Featured Product

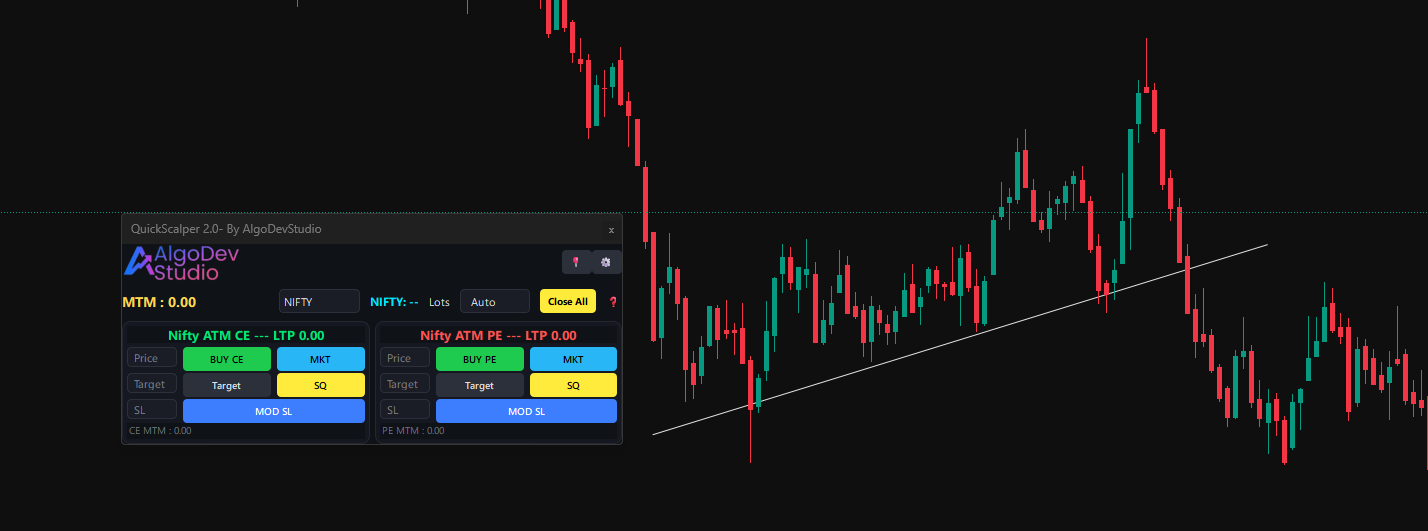

QUICK SCALPER.

The ultimate execution utility for high-volatility option scalping. Supports Dhan, Zerodha, Upstox, and Groww. Enter, manage, and exit trades in milliseconds with pre-configured hotkeys and automatic risk brackets.

- 1-Click Order Entry

- Auto-Trailing Stop Loss

- "Panic Close" Global Liquidate